Measure N A better Watsonville Community Hospital through higher

Santa cruz county outlet property tax payment

Share. Visit »

Santa Cruz County approves fire tax transfer to Scotts Valley

Proposition 19 in Santa Cruz County Blog

My Santa Cruz County Apps on Google Play

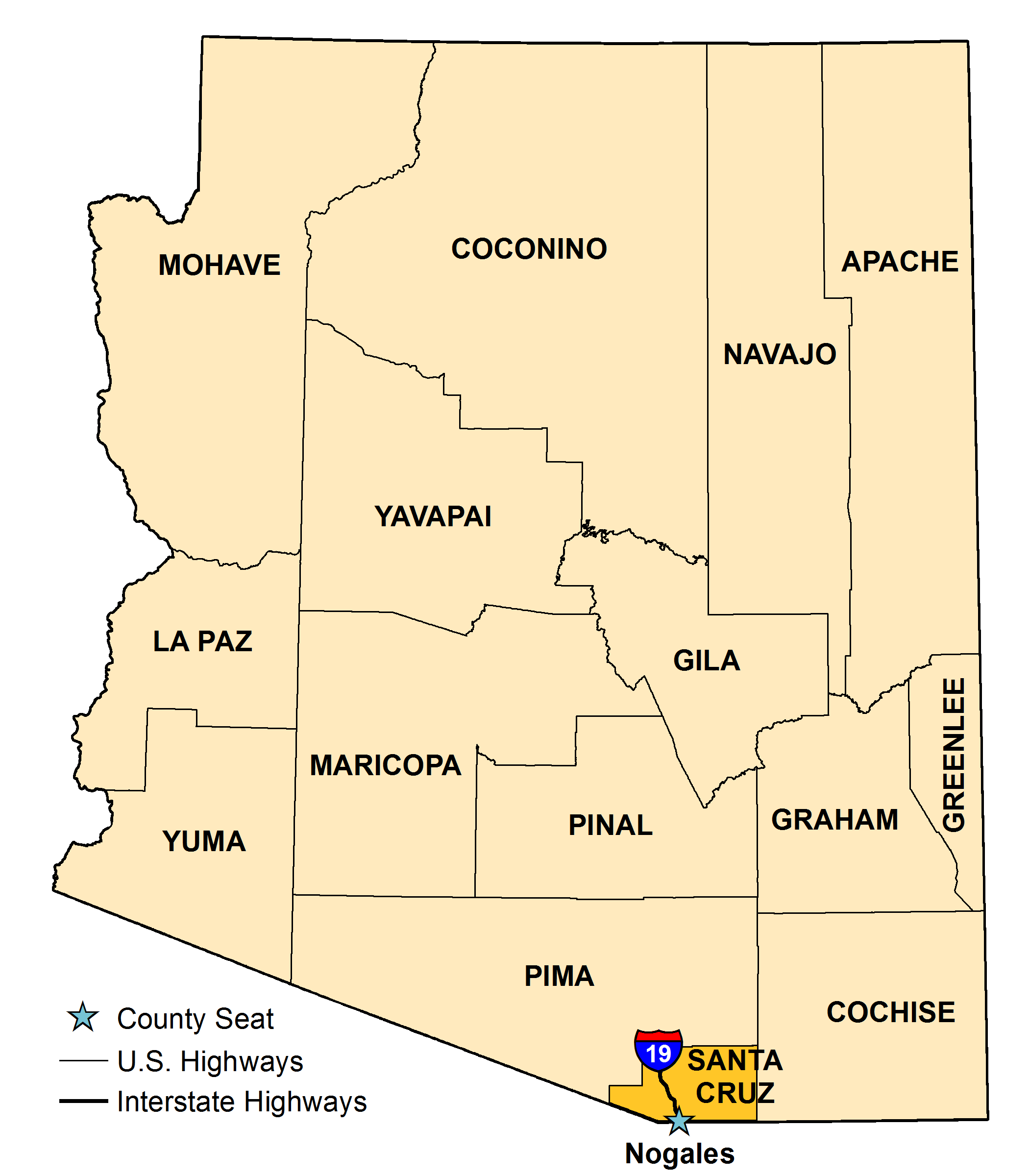

Online Payment Options Santa Cruz County AZ Official Website

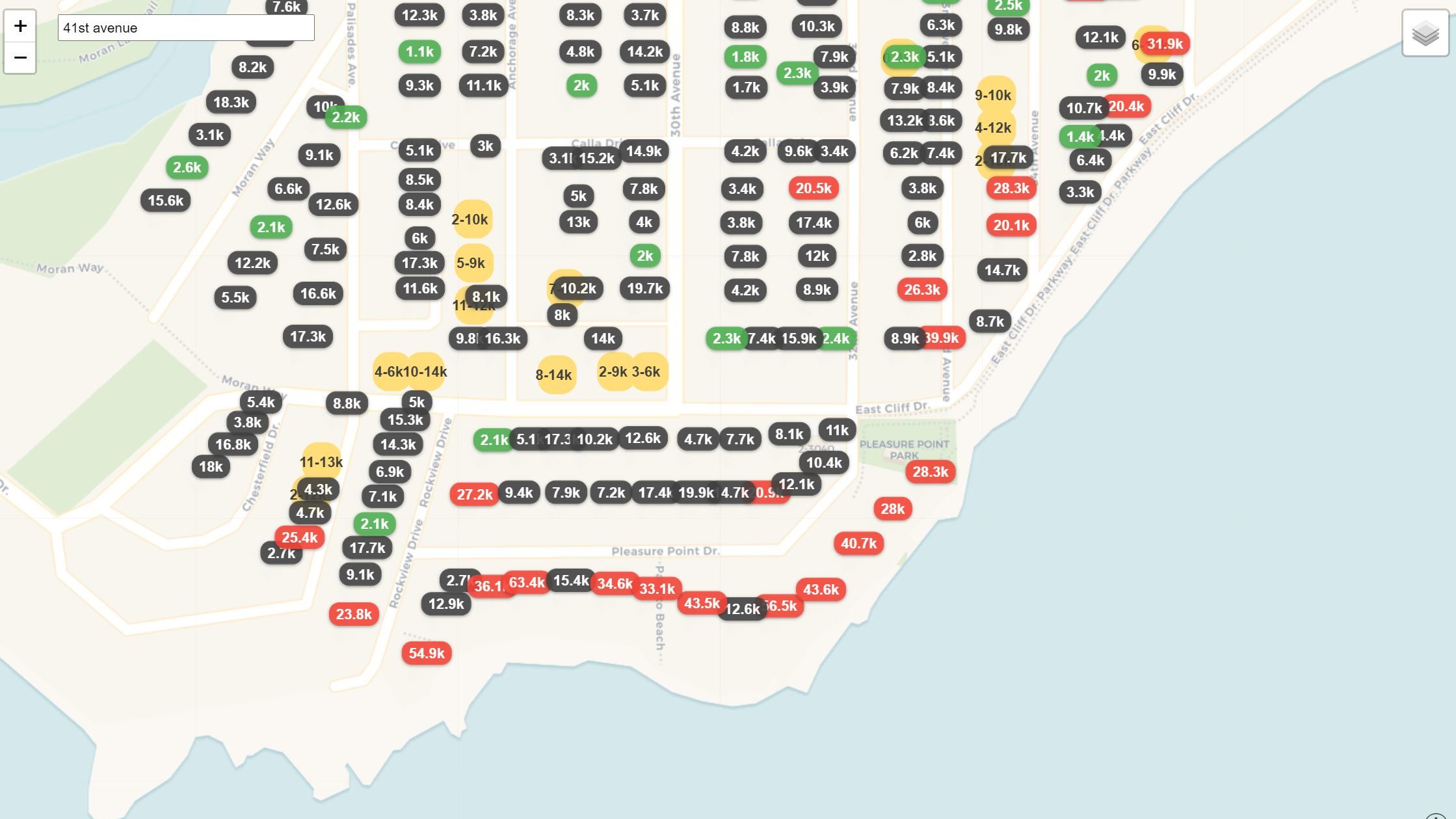

Your property tax bill might be about 70 too high. Here s how to fix it

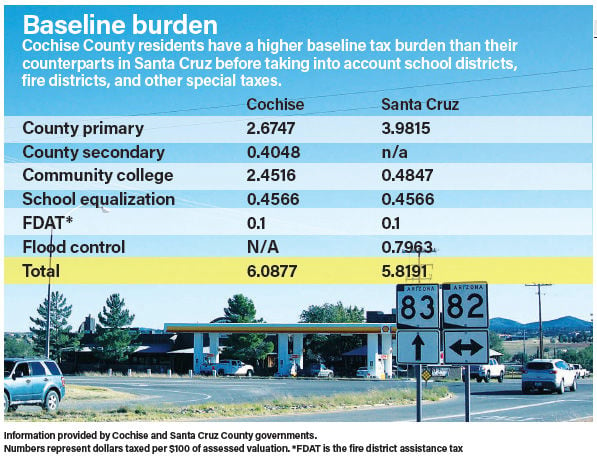

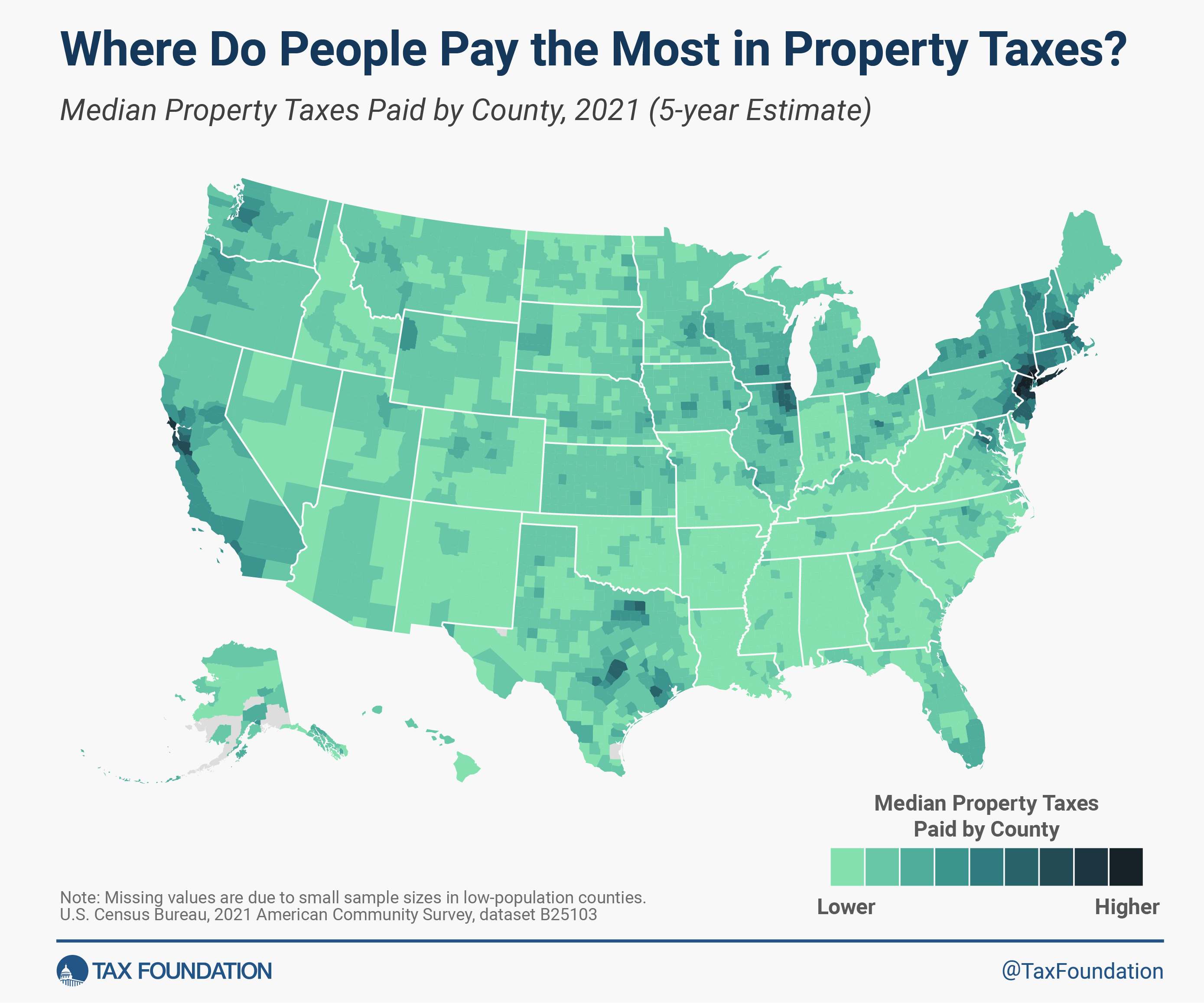

Assessors Cochise County property taxes higher than Santa Cruz

Property Tax Update No Penalties on unpaid Second Installment of

Deadline for seniors to apply for exemption from school parcel

Santa Cruz County Tax Lawyers Compare Top Rated California

Property taxes and buyer closing costs

Scam Alert County of Santa Clara California Facebook

Proposed Sales Tax Increase for Unincorporated Santa Cruz County

SCV News County Treasurer Mails Notices of Delinquent Payments

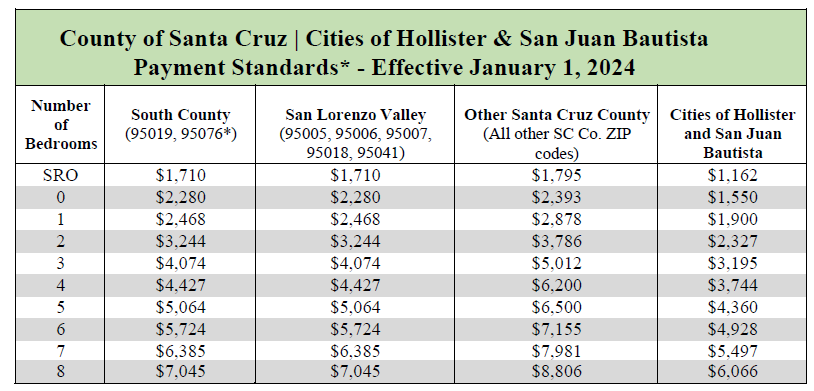

Allowances and Limits Housing Authority of the County of Santa Cruz

Proposition 13 Speculators and tax gentrification Ross Eric

SHOW ME THE MONEY

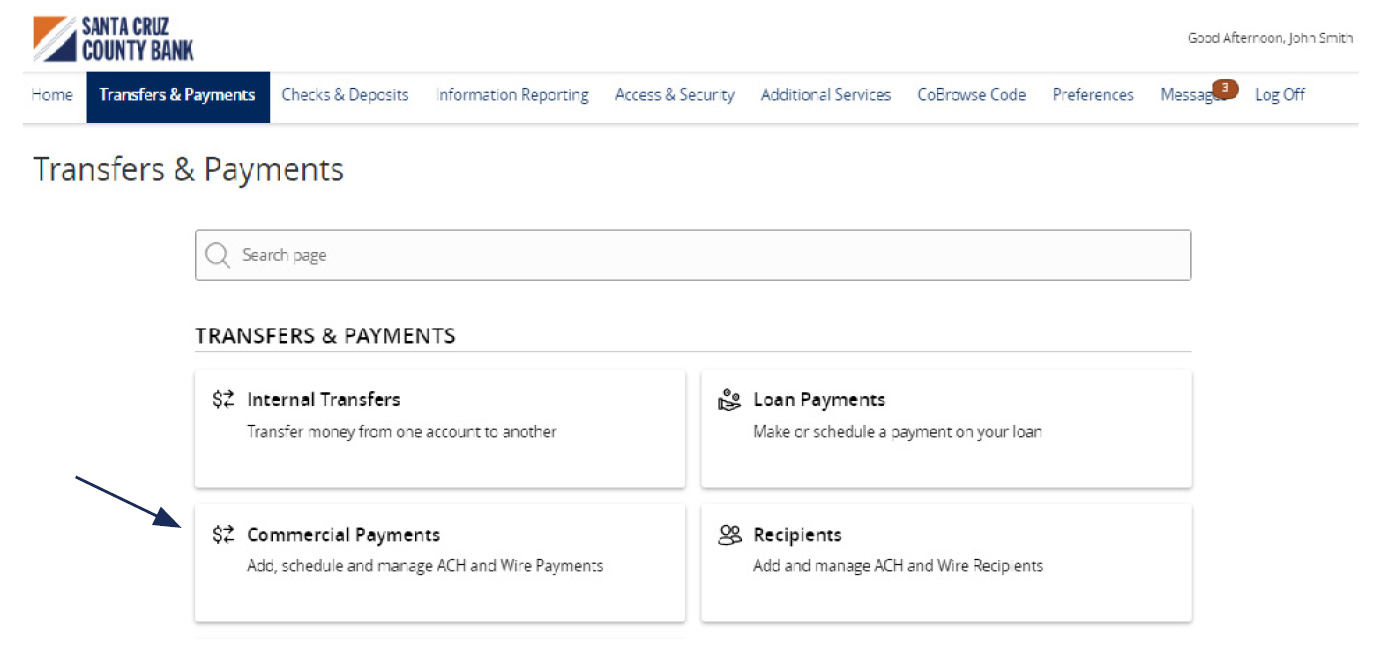

Online Banking Resources and Guides

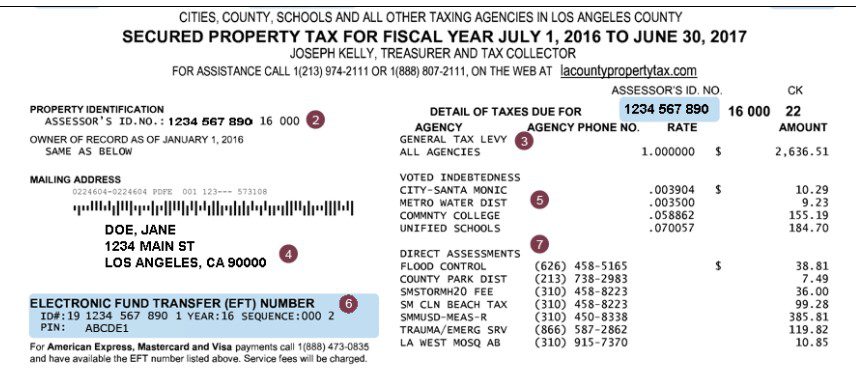

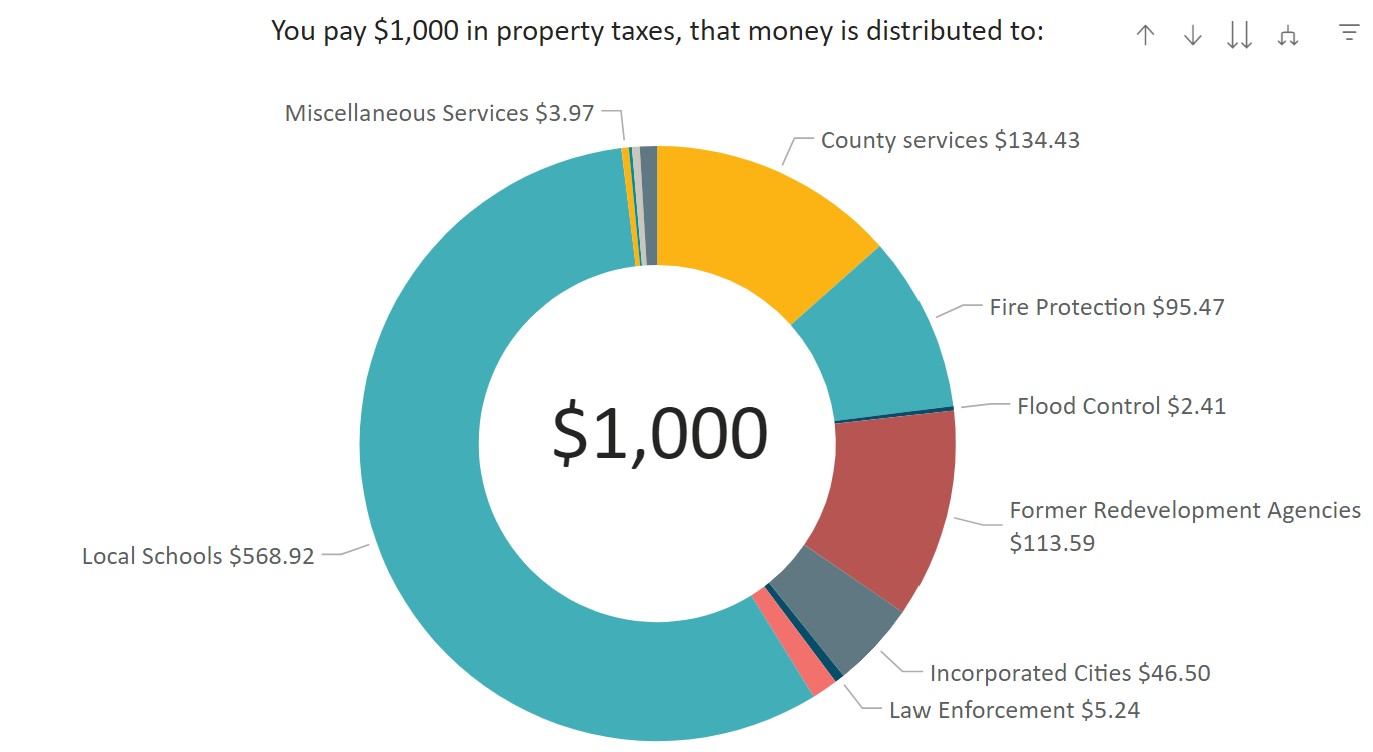

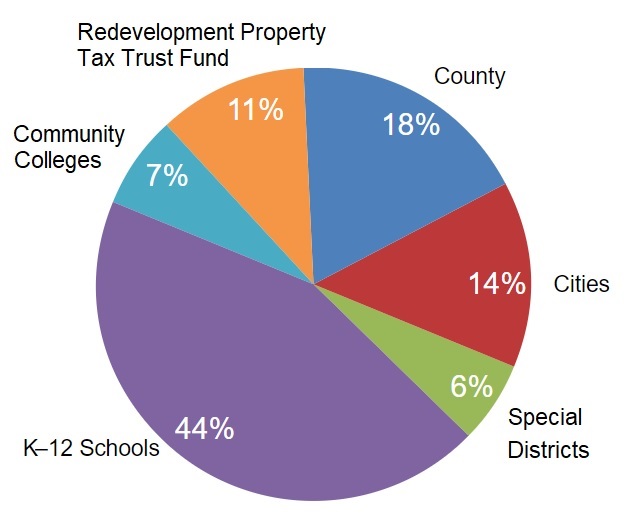

UNDERSTANDING CALIFORNIA PROPERTY TAXES

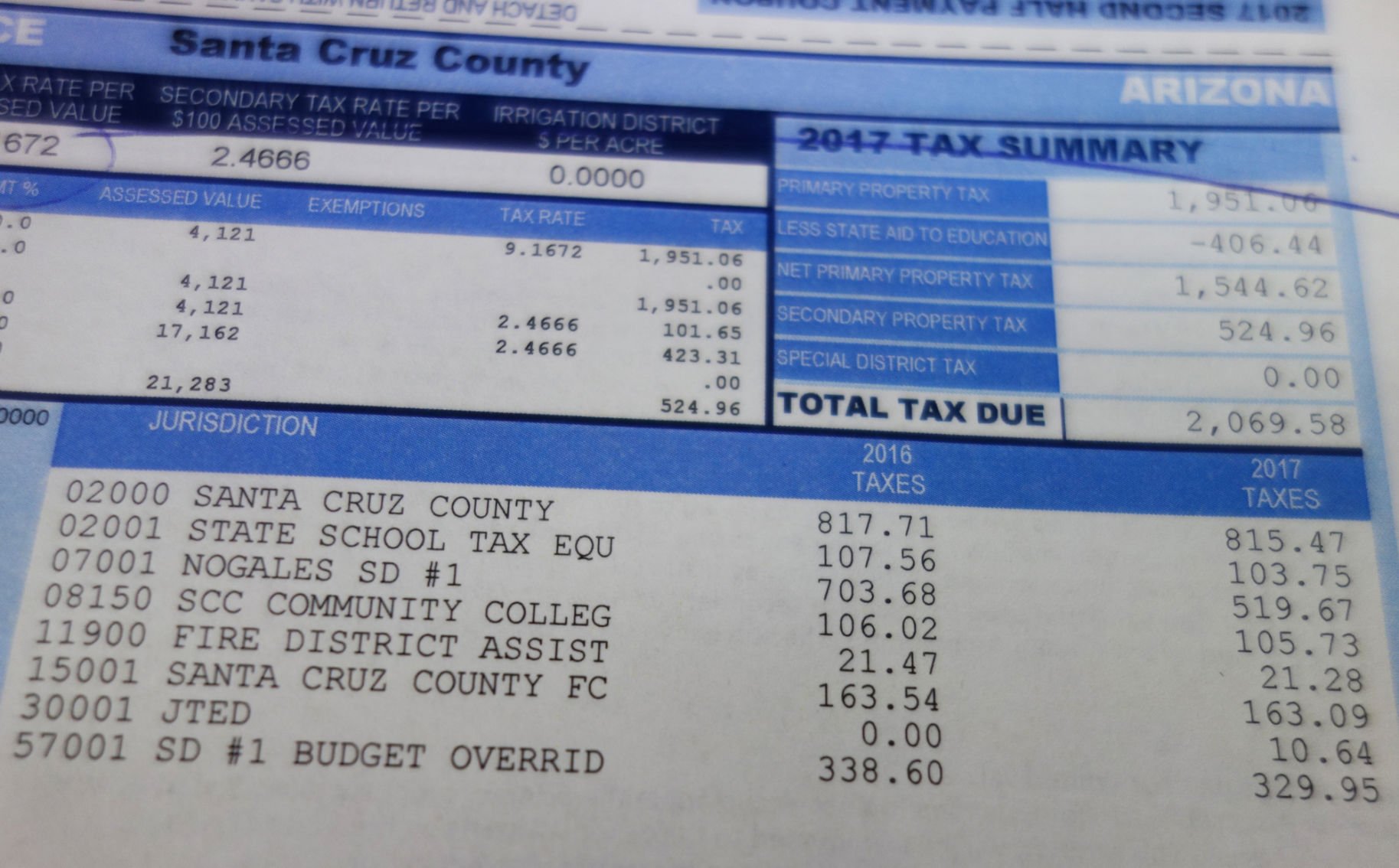

County Profile for Santa Cruz County AZ

Property Tax Bills Due Next Week In Santa Cruz County Santa Cruz

Explainer Property taxes in Santa Cruz County Santa Cruz Local

Visio 2020 09 04 Secured Bill Legend.vsdx

Maps show disparity in Santa Cruz County property taxes Santa

Online Banking Resources and Guides

Property Taxes by State County Median Property Tax Bills

County of Santa Clara on X

County of Santa Clara on X

Financial Transparency Portal Story

County expects more property tax revenue with same rates in 2020

Is your property tax assessment too high Valley of Heart s

SANTA CRUZ COUNTY TREASURER S OFFICE Santa Cruz County AZ

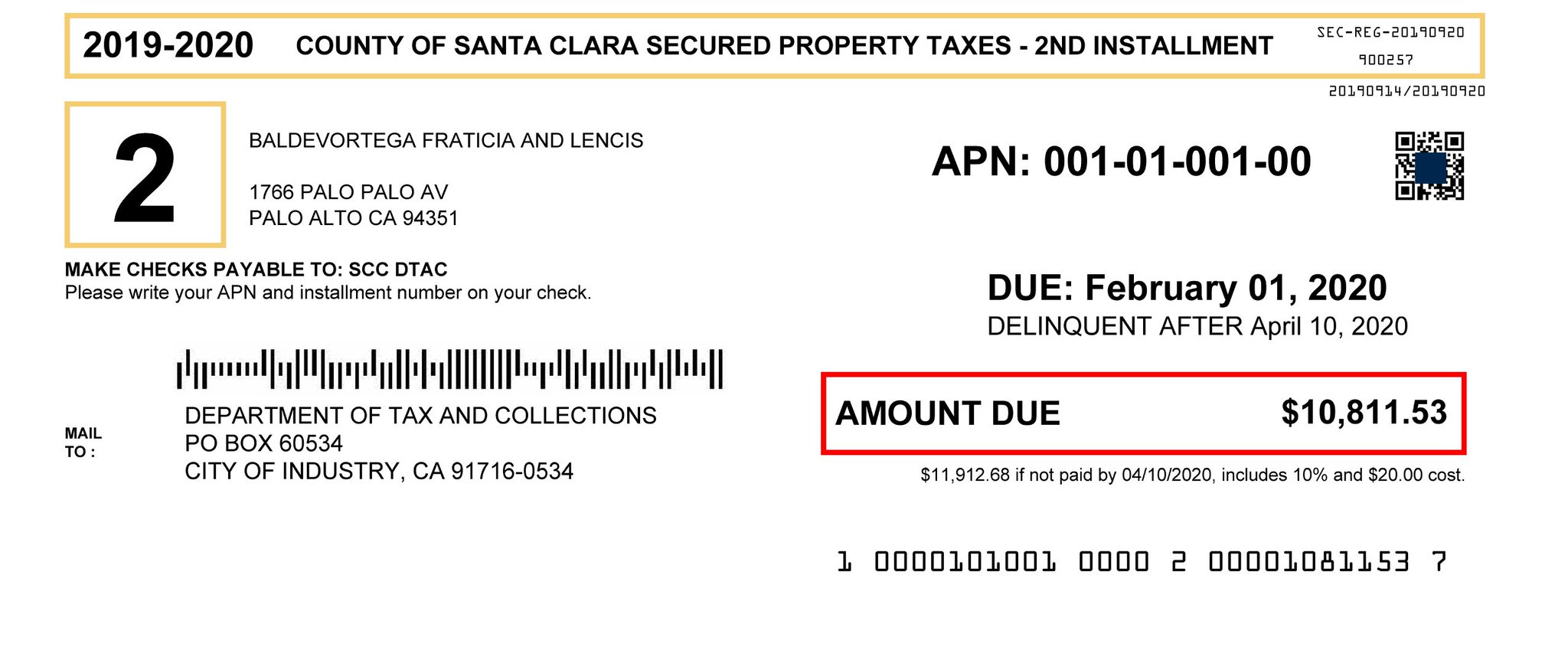

Property Taxes Department of Tax and Collections County of

Property Taxes Department of Tax and Collections County of

Tax Collector

Santa Cruz County AZ Online Payments

Santa Clara County Property Tax Tax Assessor and Collector

Business Owners eFile Property Statements

Visio 2020 07 20 Supplemental Bill Legend.vsdx

New Program Allows Taxpayers Pay Annual Property Taxes in Monthly